Three Unlicensed BDC Operators Convicted by Ilorin Federal High Court

The Federal High Court in Ilorin, Kwara State, has convicted three unlicensed Bureau De Change (BDC) operators, according to a statement issued by the Economic and Financial Crimes Commission (EFCC), the prosecuting agency, on Tuesday.

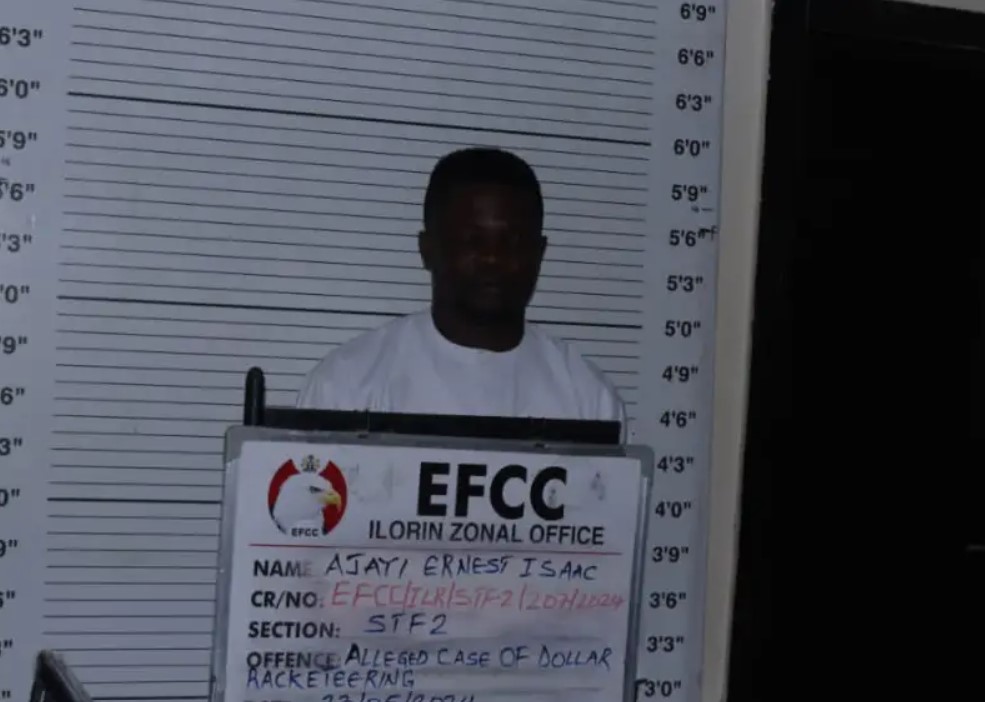

The statement identified the defendants as Mustapha Idris, Hassan Bala, and Ajayi Isaac, all natives of Chikanda in Baruten Local Government Area of Kwara State. They were prosecuted for operating a BDC without obtaining the necessary licence from the Central Bank of Nigeria (CBN).

Presiding Judge, Justice Olukayode Ariwoola, sentenced Mr Idris to 250 hours of community service, with no option of a fine, and ordered the forfeiture of CfA 33,000 and N323,000 seized from him to the federal government. Mr Bala was sentenced to six months in prison or a N200,000 fine, and his assets – Cfa 677,500 and N881,900 – were also forfeited to the federal government.

Likewise, the judge sentenced Mr Isaac to six months in prison or a fine of N500,000, while also ordering the convict to forfeit $31 recovered from him to the Federal Government.

EFCC brought the charges against them under section 57 (1) of the Banks and Other Financial Institutions Act, 2020, which prohibits any person without a valid licence from engaging in specialised banking or other financial institution business, including forex trading, in Nigeria.

Section 57(5) of the law provides that any person found culpable is liable to a minimum imprisonment of five years, a fine of at least N2 million and an additional fine of no less than N50,000 for each day the violation persists, or both imprisonment and fine.

If the offender is a corporate body, the law provides for a fine of N10 million and N200,000 for each day the violation persists.

EFCC arrested the defendants in July 2024.

They pleaded not guilty to the charges.

During their trial, EFCC prosecutors Sesan Ola and Andrew Akoja called witnesses and tendered extra-judicial statements of the defendants and different currencies recovered from the trio as exhibits.

The prosecution counsel urged the court to convict and sentence them accordingly.

Illegal BDCs in Nigeria

The activities of illegal foreign exchange operators are believed to contribute to the depreciation of naira and a conduit for money laundering.

In 2024, PREMIUM TIMES reported the demolition of shanties and structures of BDC operators in Abuja.

The office of the National Security Adviser (NSA) in February 2024, announced its partnership with CBN, EFCC, Nigerian Police Force (NPF), Nigeria Customs Service and the Nigeria Financial Intelligence Unit (NFIU) to combat the activities of illegal foreign exchange operators.

Cloud Tag: What's trending

Click on a word/phrase to read more about it.

Oko Akanbi-Oke Hijaab Ayodele Olaosebikan Zara Umar Jani Ibrahim Titus Suberu-Ajibola Mahee Abdulkadir Opobiyi Mutawalle CELF RTEAN Modupe Oluwole Kunbi Titiloye Musa Aibinu Simeon Sayomi Ojo Fadumila Mashood Dauda Michael Nzekwe Tescom.kwarastate.gov.ng NIPR Chemiroy Nigeria Limited Aminu Ado Bayero Baba Issa Dagbalodo Funke Adedoyin Kwara State Coalition Of Business And Professional Associations Bond Sheikh Alimi Sulu Gambari Yekini Adio Kwara United Eghe Igbinehi Eleyele Binta Abubakar-Mora Owu Fall Sai Kayi Muhammadu Gobir Damilola Yusuf Prince Sunday Fagbemi Convocation Ceremonies Yakub Ali-Agan General Hospital Ilesha-Baruba Abioye Bello Garba Dogo Matthew Babaoye Abdulrazaq Sanni Kwara NIPR Erin-ile Hussein Oloyede Akorede Kwara 2023 Modibbo Kawu Bankole Omisore Muyideen Ajani Bello Tunji Olawuyi Edu Stephen Fasakin Kehinde Boyede Abdulrahman Abdullahi Kayode Emir Of Yashikira Dele Momodu Nigerian Medical Association Oko-Olowo Afolabi-Oshatimehin Adenike Harriet Tinubu Legacy Forum Bio Ibrahim Ayobola Ipinlaiye Kazeem Oladepo Pius Abioje Ahmad Olanrewaju Belgore Moses Afolayan Zaratu Umar Funmilayo Braithwaite Temitope Ogunbanke Ilorin Likeminds Foundation